A year of consolidation and retrenchment

In last week’s Cue Sheet dispatch, I graded my barbecue prognostications for 2025. One of the predictions that earned an “A” was that we would see more consolidation in the outdoor cooking equipment market, which includes grills, smokers, outdoor griddles, and even wood-burning pizza ovens. And, boy, did we.

That trend was underway even before the year opened. In December 2024, Weber LLC had announced that it was acquiring Blackstone Products, the category leader in outdoor griddles. That transaction closed on May 5th, and the combined entity is now called Weber Blackstone. So far, at least, the two brands remain distinct. You can still buy Weber Slate griddles at Weber.com and the original Blackstone 36” griddle at Blackstoneproducts.com. Blackstone is reportedly starting to use Weber’s broader distribution network to make its griddles available to a larger customer base, and I’m sure other back-office functions will be merged, too.

The type of consolidation we see in the Weber/Blackstone combination is a dominant theme throughout the industry in 2025, which is in a process of retrenching and reconfiguring after a couple of really tough years.

The Post-IPO Slump

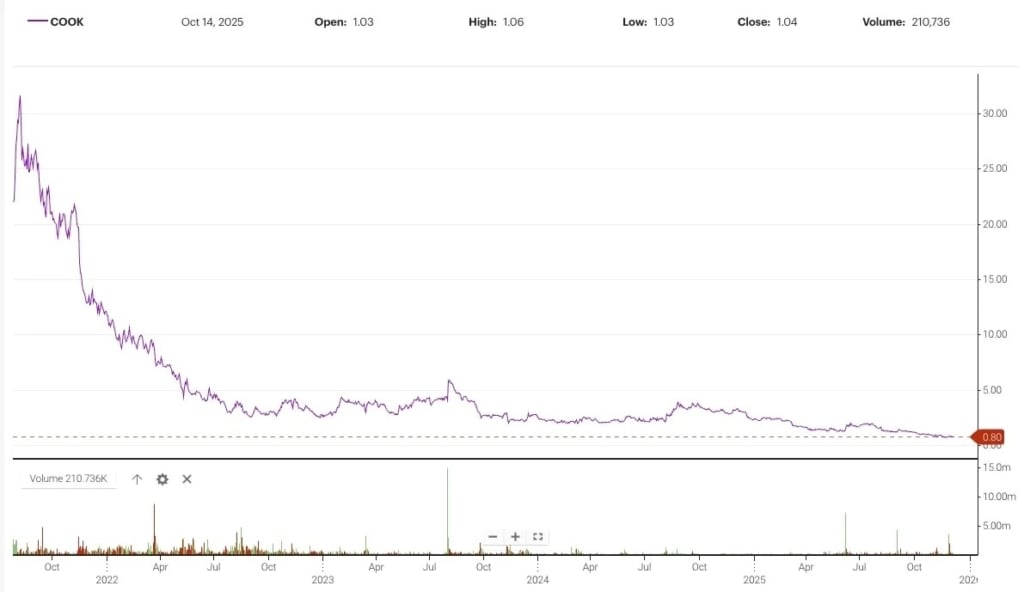

Weber, you may recall, went public in August 2021 at what turned out to be the peak of the Covid-era backyard grilling boom. Its stock promptly slid from $18 per share to under $7, and the company fired its CEO and was taken private by BDT Capital Partners in early 2023. The other big player that went public in 2021—Traeger Pellet Grills—saw an even more dramatic post-IPO slide, though so far, at least, it has retained its CEO, Jeremy Andrus.

The soaring valuations that Weber and Traeger enjoyed at their IPOs reflected a larger industry-wide confidence that the Covid-era surge in backyard cooking was a lasting trend that would keep right on growing. In hindsight, it’s easy to see what actually happened.

Much of the country was locked down, and few families were going out to restaurants or traveling for vacations. Thanks to stimulus checks, remote work, and a dearth of other things to spend money on, many Americans chose to spring for a fancy pellet cooker or offset smoker.

It didn’t take too long, though, for everyone who wanted a shiny new grill to have gone out and bought one. Then the world opened back up, inflation spiked, and outdoor cooking sales not only flat-lined but began to decline. Weber’s revenue dropped 20% in a year, from $1.98 billion in 2021 to $1.59 billion in 2022, the last year it reported financials before being taken private. Traeger’s sales peaked in 2021 at $786 million then slid sharply to just $656 million in 2022 and $605.9M in 2023.

For a while it looked like the market had reached bottom. Traeger posted $604 million in revenue in 2024, only a slight less than in 2023. Equally notable, it posted a $2.9 million operating loss, a substantial improvement over the $55 million loss the previous year. In March, the company was forecasting 2025 sales would land somewhere between $595 million and $615 million, or basically flat.

That initial forecast was made before the Trump administration announced its “Liberation Day” round of tariffs in April, and those import duties are perhaps the most significant factor affecting the live-fire equipment industry in 2025. 80% of Traeger’s grills are manufactured in China, and the rest in Vietnam, two countries squarely in the tariff crosshairs.

In its quarterly report for Q1 2025, which was released in May, Traeger withdrew its previous guidance, citing “the uncertainty around rapidly evolving trade policy and the implications on the economy and our business.” As of November, the company is forecasting 2025 revenues of between $540 million to $555 million, a significant drop over last year’s sales. The decline is attributed to the company’s having to raise prices, which in turn is reducing sales.

To adapt, Traeger is racing to diversify its production outside of China and increase so-called “supply chain resilience.” It reported in November that it was negotiating costs with its contract manufacturers and expected a “meaningful production shift from China by the end of 2026.”

As a public company Traeger has to disclose its financials, so its fortunes are easier to assess than its privately held competitors’. Those companies are subject to the same macroeconomic forces, though, and we can assume they’re largely in the same boat.

Getting Back to the Basics

Traeger, ironically, was slower than its peers to move manufacturing overseas, producing grills in its own factory until 2010, when it started outsourcing to China. Private equity firm Trilantic Capital Partners took over the company in 2014 and installed Andrus as CEO, and he continued the outsourcing push, shuttering Traeger’s warehouse and trucking operations and moving those functions to external vendors. In a 2019 article in the Harvard Business Review, Andrus explained, “we see our brand as focusing on cooking and food, not on the metal or mechanics of the grill.”

Indeed, the S-1 filing for Traeger’s 2021 IPO pitched the business more like a digital media or tech company than a boring old manufacturing firm. In addition to repeatedly using “Traeger” as a verb, the S-1 is full of marketing buzzword salads like this:

Traegering is built on the radical idea that home cooking can become a universally enjoyable craft and an elevated experience when people have the right platform. We believe our owners are excited to fire up their Traegers and cook because of our disruptive approach.

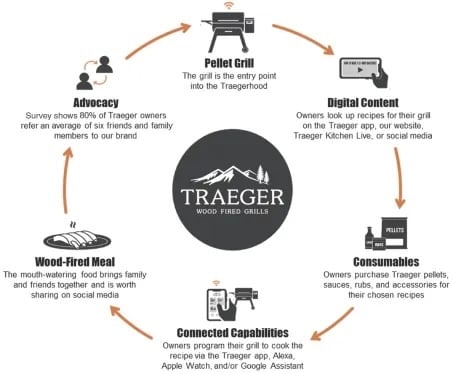

The pellet grill was merely as the “entry point into the Traegerhood,” a “user experience” that included digital content, social media interactions, and “connected capabilities” with smartphone apps, Alexas, and Apple watches.

In July 2021, Traeger acquired UK-based Apption Labs, which designed cooking equipment like the Bluetooth-connected MEATER “smart” thermometer. Traeger was also embroiled in a patent dispute with competitor Green Mountain Grills not over the design of pellet grills but rather over the concept of “cloud-connected” grills. (That suit was settled in 2024.)

Traeger’s post-IPO growth plan was to induce consumers to “follow us into other categories in the food-at-home market,” including digital content (recipes, live streaming cooking classes) as well as “recurring revenue consumables.” That last category encompasses not just the wood pellets consumed by the pits but also rubs, sauces, and other foods. Just four month after its IPO, the company introduced Traeger Provisions, a line of premium frozen meal kits.

Things look quite different four years later. In July 2022, the company axed the Traeger Provisions meal kits and laid off 14% of its global employees. This year it launched a further belt-tightening initiative called Project Gravity to reduce annual expenses by $50 million. The first phase included another round of layoffs and moving the business operations of the MEATER thermometer unit to Salt Lake City.

The company is also getting out of the direct-to-consumer business, winding down online sales at the Traeger.com web site and directing customers to retailer sites instead. The company has even killed its signature Costco Roadshow, which once sent dozens of brand ambassadors to conduct cooking demonstrations at Costco stores across the country.

Traeger, in other words, is now acting more like a traditional metal and mechanics manufacturer and not a digital disruptor. It turns out these companies are actually in the business of making the razors, not the blades. Focusing on selling the big-ticket equipment—grills, griddles, smokers—seems the key to future success.

Further Consolidation

Weber and Traeger were hardly the only companies looking to streamline operations and consolidate markets in 2025.

W. C. Bradley Co., a privately held conglomerate based in Columbus, Georgia, has its fingers in everything from real estate development to hunting gear and TIKI Brand torches. It has been in the outdoor cooking market since 1948, when it launched the Char-Broil brand of charcoal grills, and it acquired New Braunfels smokers in 1997 and Oklahoma Joe’s in 1998. In 2023, Bradley moved aggressively into the pellet grill and outdoor griddle market when it bought Dansons, which owned the Pit Boss and Louisiana Grills brands.

So far, the acquired companies have maintained separate brand identities, but in July Bradley launched Outdoor Brands, LLC, to bring the products together under a single business entity. No immediate branding changes are planned, but the move will align relationships with suppliers, vendors, and retailers. One wonders whether it might also position Bradley to spin off Outdoor Brands as a standalone company or sell it to another firm in the future, which is exactly what Middleby is looking to do with its portfolio of outdoor cooking products.

Middleby, in case you don’t recognize the name, is primarily a manufacturer of commercial food service equipment. It caught backyard fever along with everyone else in 2022, acquiring Masterbuilt, Char-Griller, and Kamado Joe at a time when those companies were enjoying record sales.

Flash forward three years, and the picture isn’t so rosy. In its latest quarterly report, Middleby disclosed that within its Residential Kitchen division, which includes outdoor grills as well as indoor appliances like Viking and AGA, the indoor brands grew but were offset by “tariffs impacting sales of outdoor products.” The company took a $79 million non-cash impairment charge, writing down the goodwill value they had assumed when they acquired the outdoor grill businesses. That’s accountant speak for the brands’ turning out to be much less valuable than Middleby originally thought, or, as we would put it here in South Carolina, “those dogs don’t hunt.”

The company is now conducting “a strategic review of our Residential Kitchen business unit” and is evaluating of a range of options, including “a potential separation”—that is, selling the unit or spinning it off as a standalone company.

Looking Ahead

So, what do all these movements suggest we’ll see as 2026 unfolds? Regardless of whether W. C. Bradley and Middleby retain their outdoor cooking lines or spin them out, the lion’s share of the market will still be owned by just a handful of large firms. One could easily see a private equity-backed company like Weber wanting to snap up some of the Bradley or Middleby brands, creating even further consolidation.

So far, the roll-ups have largely kept each of their brands distinct while integrating the behind-the-scenes functions. One wonders, though, how long a company like Weber Blackstone will offer three separate lines of propane griddles or Bradley’s new Outdoor Brands will maintain three pellet cooker brands (Pit Boss, Oklahoma Joe’s, and Louisiana Grills.)

One thing is certain: instead of specializing in just one type of product, the big players want to play in as many categories as they can. Traeger, which invented the pellet grill category, made its first entrance into the outdoor griddle market in 2023 with the three-zone Flatrock and doubled down this year with the smaller Flatrock Two-Zone griddle. Weber, for its part, launched its Slate line of griddles in 2024 and also moved into the trendy pellet smoker market with the Searwood pellet grill. This year it added the more affordable Weber Smoque pellet cooker, too.

The real question is how successful these companies will be in diversifying and perhaps even on-shoring their supply chains and what the long-term effects of tariffs will be. When it comes to predicting how that will shake out, I’ll admit I haven’t a clue.

This dispatch was originally published in the Robert F. Moss Newsletter on Substack. Subscribe today for free to have his latest writing delivered straight to your inbox.

High quality websites are expensive to run. If you help us, we’ll pay you back bigtime with an ad-free experience and a lot of freebies!

Millions come to AmazingRibs.com every month for high quality tested recipes, tips on technique, science, mythbusting, product reviews, and inspiration. But it is expensive to run a website with more than 2,000 pages and we don’t have a big corporate partner to subsidize us.

Our most important source of sustenance is people who join our Pitmaster Club. But please don’t think of it as a donation. Members get MANY great benefits. We block all third-party ads, we give members free ebooks, magazines, interviews, webinars, more recipes, a monthly sweepstakes with prizes worth up to $2,000, discounts on products, and best of all a community of like-minded cooks free of flame wars. Click below to see all the benefits, take a free 30 day trial, and help keep this site alive.

Post comments and questions below

1) Please try the search box at the top of every page before you ask for help.

2) Try to post your question to the appropriate page.

3) Tell us everything we need to know to help such as the type of cooker and thermometer. Dial thermometers are often off by as much as 50°F so if you are not using a good digital thermometer we probably can’t help you with time and temp questions. Please read this article about thermometers.

4) If you are a member of the Pitmaster Club, your comments login is probably different.

5) Posts with links in them may not appear immediately.

Moderators